Startup valuations across the technological spectrum have been impacted as rising interest rates and concerns about an impending recession dampen investor enthusiasm, leading to a move away from risky projects that burn through cash quickly.

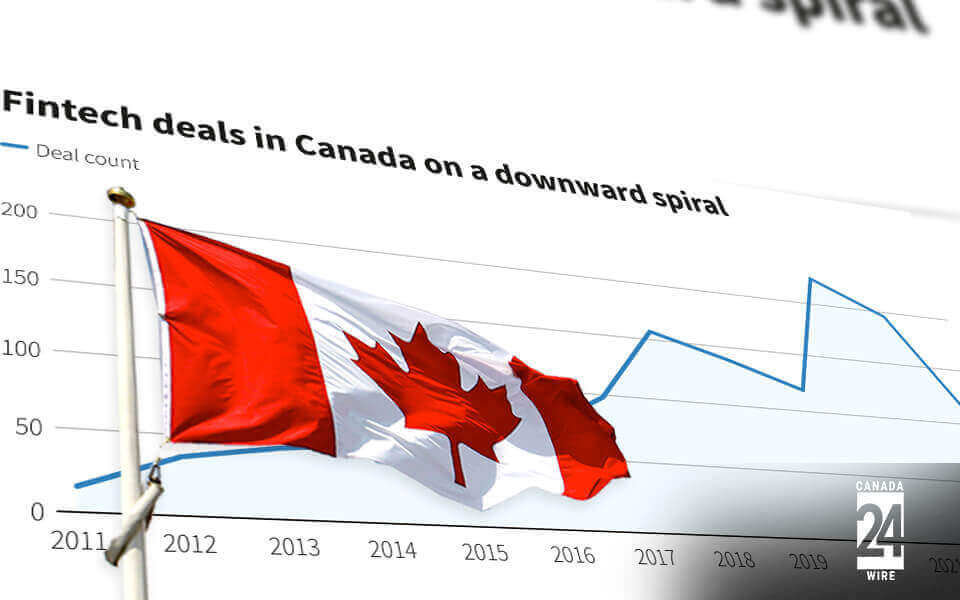

According to information gathered by PitchBook, the investments made by KPMG Canada between January and June 2023 totaled $353.7 million across 57 deals, including venture capital, private equity, and merger and acquisition activity. Since the preceding year, there have been no initial public offerings.

109 acquisitions totaling $834.1 million were completed in the first half of 2022. According to the study, in 87 acquisitions, $1.09 billion was spent in the second half.

“Investors are still quite concerned about the state of the global economy, with fears of a recession, elevated inflation, and interest rates continuing to strain valuations significantly,” says Geoff Rush, KPMG Canada’s National Financial Services Leader.

While several fintech companies have managed to conserve or stretch their capital this year, analysts point out that those who still need to seek money shortly may do so at flat values and lower rounds.

“By the end of 2023 or early 2024, we could see some stability return to financing markets. Unfortunately, that timeline may mean that some more mature fintech that has yet to establish continuous positive cash flows may face tough options by then, such as selling at a loss or just shutting down,” said Georges Pigeon, a partner in KPMG’s acquisition consulting group in Canada.